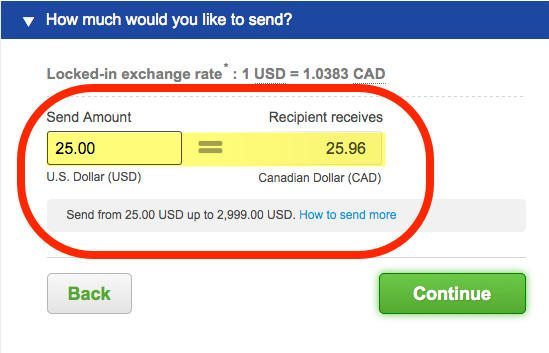

Let’s get specific with an international bank transfer example. That means fair, cheap money transfers every time. We just use the exchange rate – independently provided by Reuters. However, as you’ll see further on, this is where Wise is an exception.Īt Wise, we never hide extra fees and charges in the exchange rate. It’s rare for transfer providers to actually offer the mid-market rate - what Xoom calls the wholesale or interbank rate. In fact, on average, banks can mark up the exchange rate by somewhere between 4-6%. Why? Because almost everyone in the industry does it. In essence, on top of the fee they charge, Xoom squarely notes that they’re making money on the exchange rates they give you.

In addition to the transaction fee, Xoom also makes money when it changes your send currency into a different currency.¹ On Xoom’s fees and exchange rate calculator, they have a note: It’s always worth reading the smallprint when you transfer money. In fact they stop short of actually calling it a fee. ⁱ The figures in this table are indicative only - they might change, and could vary depending on which country you’re sending to.Īs you’ll see from the table, Xoom doesn’t charge a specific conversion fee. Somewhere between 4-6% - best to check it against an online currency converter Minimum of $1.99, but can rise substantially depending on currency and transfer amount $0 - $10, depending on currency and transfer amount Let’s have a look at this table about Xoom’s international fees: Xoom international transfer Sometimes, in fact, there’s no sending fee at all for a bank transfer, while the credit or debit card fees can shoot up quite steeply. But for higher amounts, like US$1,000 to Indian rupees, it’s often cheaper to pay via your bank account and more expensive to use a credit/debit card. The amount of money you want to transfer andįor low transfer amounts, from $10-100 for example, you might find that these methods all cost the same.

0 kommentar(er)

0 kommentar(er)